Ever notice how certain currency pairs seem to move in predictable patterns at specific times of the year? It’s not just coincidence—seasonal trends in forex are real, though they’re often overlooked. Let’s break down how these patterns play out in major pairs like EUR/USD, USD/JPY, and GBP/USD, and why sometimes, the market throws a curveball.

Why Seasonal Trends Matter in Forex

Seasonality in forex isn’t about weather changes—it’s tied to economic cycles, fiscal policies, and even human behavior. Think of it like retail sales spiking before holidays, but for currencies. Central bank meetings, tax seasons, and corporate repatriation flows all leave fingerprints on price charts.

Key Drivers of Seasonal Patterns

Here’s what fuels these trends:

- Holiday liquidity drops: Thin trading around Christmas or Golden Week (Japan) can exaggerate moves.

- Quarter-end rebalancing: Multinationals adjust hedges, shifting demand for certain currencies.

- Commodity cycles: CAD and AUD often mirror oil and mining export seasons.

- Interest rate timing: Central banks lean toward predictable meeting schedules.

EUR/USD: The Calendar’s Favorite Pair

The euro-dollar pair has quirks you could set a watch to. Well, almost. Since 2010, EUR/USD has averaged a 1.2% gain in April, likely tied to eurozone fiscal year-end flows. But December? Historically choppy—liquidity dries up, and algo traders dominate.

| Month | Avg. % Change (2010-2023) | Anomaly Year |

| April | +1.2% | 2020 (COVID drop) |

| August | -0.8% | 2017 (Euro rally) |

| December | ±0.3% | 2016 (Fed hike spike) |

That said, 2022 bucked trends—war in Ukraine sent the euro tumbling in Q2, proving seasonality isn’t destiny.

USD/JPY: The Yen’s Fiscal Year Twist

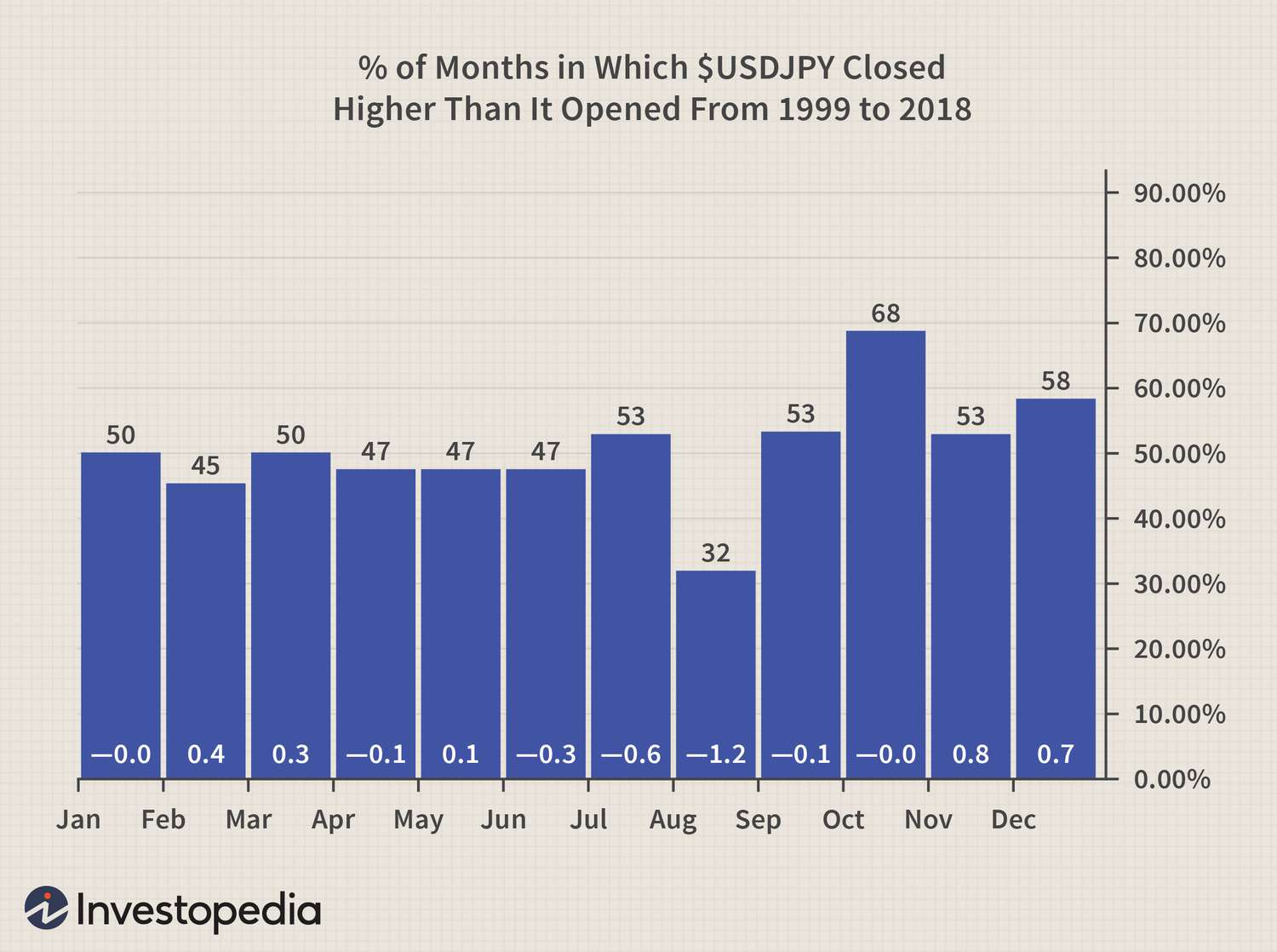

Japan’s fiscal year ends in March, and—here’s the thing—Japanese firms often repatriate overseas profits, boosting yen demand. Since 2015, USD/JPY has fallen 70% of the time between mid-February and April. Except in 2021, when U.S. Treasury yields spiked, dragging the pair up 4%.

Another quirk: August tends to be weak for USD/JPY. Why? Lower U.S. trading volumes let yen carry trades unwind.

GBP/USD: Brexit Broke the Pattern

Pre-2016, sterling loved November—UK budget announcements often sparked rallies. But post-Brexit? That pattern’s gone. Now, GBP/USD sees sharper moves during BOE meeting weeks, especially if they clash with Fed timing.

When Anomalies Strike: Black Swans vs. Hidden Trends

Seasonality works… until it doesn’t. Major disruptions like COVID-19 or geopolitical shocks can override historical patterns. But sometimes, what looks like an anomaly is just a deeper trend—like how USD/CAD’s traditional May slump faded as oil sands production ramped up year-round.

How Traders Use (and Misuse) Seasonality

Smart money watches seasonal trends but doesn’t rely on them. Here’s why:

- Confirmation bias risk: It’s easy to cherry-pick data that fits a narrative.

- Structural shifts matter: Negative rates in Europe changed EUR seasonality post-2014.

- Liquidity is key: A trend that worked with 2010’s volumes may fail today.

The Bottom Line: Patterns as Clues, Not Rules

Seasonal trends in forex are like tide tables—they tell you when the water should move, but storms change everything. The best traders use them as context, not crystal balls. After all, markets have a habit of humbling anyone who thinks they’ve cracked the code.